Economic competition happens continuously, even in routines. The first barter exchange cannot be dated, but the form of equivalence always dictates the rules. For example, I want a bottle of water after a run. I have no cash and no card. The store typically will not accept labor as payment. My effort cannot be converted into the price of the bottle at the moment of exchange. The system recognizes only one equivalent. Without it, the transaction does not exist.

The dollar in onchain markets operates through the same logic of recognized equivalence. The U.S. national debt keeps growing, yet stablecoins do not weaken the dollar. They reinforce it. Capital that should strengthen the reserves of other states flows instead to USDT and USDC issuers, entities regulated by U.S. authorities. This creates a closed financial circuit: reserves demand Treasuries, Treasuries support the dollar, the dollar supports stablecoins, and stablecoins bypass traditional financial restrictions, feeding liquidity back into the dollar system.

For Washington’s counterparties, the result is the same: they continue to support the U.S. debt machine, even if they imagine themselves outside of it. Moscow and Beijing see in this a mechanism of gradual, silent restructuring of U.S. external debt. Obligations move into tokens whose value adjusts flexibly. Inflation erases past commitments without official write-offs. The U.S. has been selling Treasuries for decades, diluting the value of each outstanding dollar. A hundred dollars in 2005 and a hundred dollars in 2025 are not the same instrument.

The picture is reinforced by the data: 99.8% (pretty huge amount) of stablecoins in crypto are pegged to the U.S. dollar. This is not a simple dominance. It is the capture of the digital economy’s monetary layer before it has even properly formed.

The scale of the shift becomes visible in the numbers.

Stablecoin supply grew 106 percent since last year, reaching 46 trillion dollars. Most activity sits on Ethereum and Tron, followed by rising flows on Base, Solana, Aptos, and BNB. USD-denominated stablecoins — USDT and USDC — dominate the market. All other issuers combined account for roughly 13 percent.

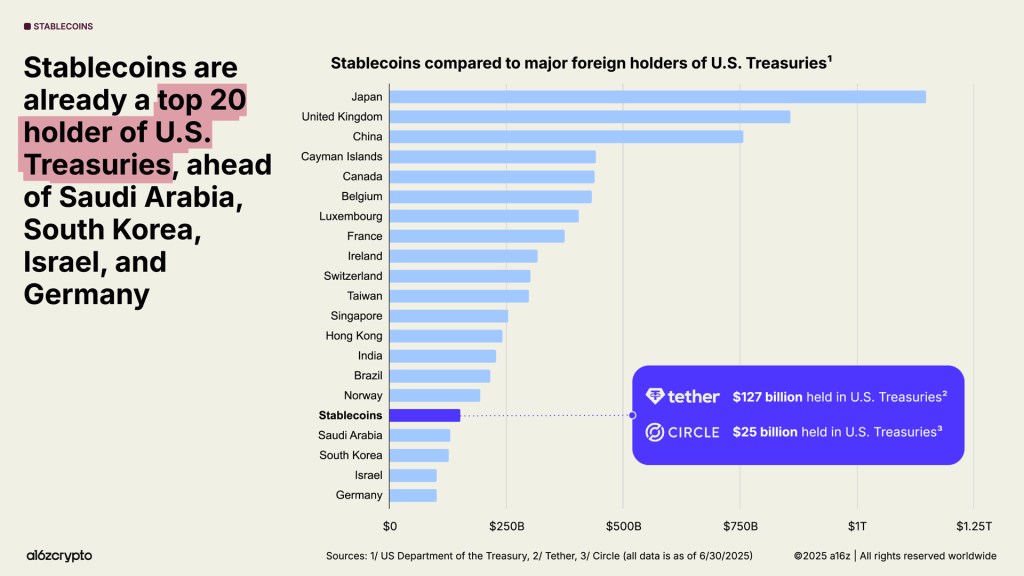

Stablecoins have now become the 17th largest holder of U.S. Treasuries, up from 20th place in 2024, with around 150 billion dollars in exposure. They now sit above Saudi Arabia, South Korea, Israel, and Germany. Only Japan, the U.K., and China hold more. Reports note that stablecoins strengthen the dollar and reduce pressure on U.S. sovereign debt even as that debt increases. Even a16z’s macro research pointed to the same structural effect.

| What does it mean when stablecoin issuers hold Treasuries? | The mechanism is straightforward: Stablecoin issuers mint tokens → they buy U.S. Treasuries as backing → this creates additional demand for U.S. sovereign debt. This demand is global, permissionless, and not limited by traditional banking restrictions. Users worldwide can acquire stablecoins even when access to dollar banking rails is blocked. |

| Why the U.S. loses nothing? | Capital leaks out of the reserve systems of other countries and flows into dollar stablecoins. The debt does not disappear — it remains externalized, but now held via intermediaries regulated by U.S. agencies. External influence on issuance volumes is effectively impossible. |

| Why this benefits the U.S? | There is a persistent, structural demand for Treasuries through stablecoin issuers. Global users, including those outside the reach of U.S.-aligned financial institutions, still end up buying a synthetic dollar. Attempts by sovereign funds to reduce USD exposure are offset by the expansion of the stablecoin layer. |

| Why Russia and China view this as a pathway for the U.S. to soften or partially neutralize its external debt? | Debt can migrate into tokenized form, where its underlying value can be repriced under new monetary conditions. When the monetary format changes, the rules change. Old obligations can be diluted, overridden, or de facto devalued under the guise of technological progress. |

Offline, the dollar still holds 56 percent of global reserves and around 50 percent of international settlements. Now the same dominance extends into digital infrastructure — global exchange APIs, DeFi liquidity, credit markets, bridges, and RWA platforms. Southeast Asia, Africa, and Latin America are returning to the dollar not through banks but through crypto rails. The U.S. gains global financial presence without direct investment. The dollar becomes the default logic of the onchain world.

In 2025, the market was flooded with stablecoin announcements. There is nothing surprising. A currency remains a currency only if it fulfills four roles: unit of account, means of payment, reserve, and asset. Dollar stablecoins satisfy all four.

- Onchain pricing is denominated in USD

- Cross-border crypto payments run on USDT and USDC

- DeFi accepts the dollar as universal collateral

- RWA markets are priced in USD

Not issuing national stablecoins is not a kind of delay. It is an exit from digital economic loops for years.

CBDCs do not solve this. They are legally and technically closed. They function as tools of domestic monetary control, not as currencies of global digital commerce. mBridge, BRICS bridge, and similar interbank constructions are pipes for regulated institutions. They do not create user-level liquidity. They do not create an economy around them.

On this background, the Russian logic becomes clear. The regulator is not avoiding stablecoins because it distrusts the technology. It is solving a different, primary task: giving domestic businesses fast liquidity inside a controlled framework. That is why the Digital Financial Assets market grew in Russia, and grew specifically as a market of digital debt. These are short claims with clear maturity, yield, and simple issuance. Useful for internal corporate treasury. But they are not currencies, not settlement instruments, and not carriers of international liquidity. CFAs do not create an onchain economy capable of competing with the dollar. Digitalization in Russia followed a banking logic: faster borrowing, stronger oversight, higher transparency. This makes sense for the domestic market, but it leaves a vacuum at the level of digital currency, a vacuum instantly filled by the dollar via stablecoins.

Launching national stablecoins is not an attempt to imitate the U.S. It is an attempt to re-enter the game.

While Moscow and Beijing fight dollarization in the banking sector, they are absent in the onchain sector — P2P payments and stablecoin flows growing 50 percent annually. This absence is a strategic error. The digital economy does not tolerate empty spaces. If the ruble and yuan do not fill that layer, the dollar does.

Advantages:

1. A monetary ecosystem forms around the currency: trading, lending, market-making, RWA issuance, derivatives.

2. Reduced sanctions vulnerability.

3. Lower cost of international transfers.

Risks of inaction

- the dollar returns through stablecoins;

- yuan and ruble remain outside global SME digital trade;

- standards and liquidity stay under U.S. control;

- every transaction carries a hidden “dollar tax” via fees and infrastructure dependency

What is needed: national onchain infrastructure, regional financial corridors, and a fully compatible digital currency layer capable of operating in global markets.

Russia is moving cautiously: experimental regimes look more like preparation for a ruble stablecoin, though primarily as a sanctions-resilience instrument. China follows a strict line: crypto is banned, digital yuan is the priority. But private business does not wait. Through Kyrgyzstan and Kazakhstan, ruble-backed and yuan-backed stablecoins are already being launched. The market expands aggressively. The window of opportunity closes fast.

Falling behind in onchain economics cannot be corrected by policy statements. Only liquidity, standards, and real digital currencies correct it. The United States is building a new global financial layer. Others act as if time still belongs to them.

It doesn’t.